Disclaimer: All views and opinions are those solely of the author and for purely educational purposes only. Please do your own research before assuming, investing, or sharing. Financial information extracted from Bloomberg Intelligence and publicly available resources.

If you were to google “amazon,” you don’t get the largest river in the world—the Amazon River—but rather the largest e-commerce company in the world, Amazon.com. A company like Amazon has seen quite the transformation in the past two decades, raking in a market capitalization of $1.6 trillion! From its humble beginning as an online bookstore to now focusing on cloud computing and artificial intelligence, Amazon seems to be the behemoth that never stops growing. With the world as their oyster, the possibilities for expanding Amazon are endless — it might help to consider where, oh where, can Amazon go?

Capturing online used car dealership market

Concerns about catching COVID-19 and its variants through public transport (we’ve all seen some things, haven’t we?) have had many individuals buying personal vehicles for their day-to-day errands and work.

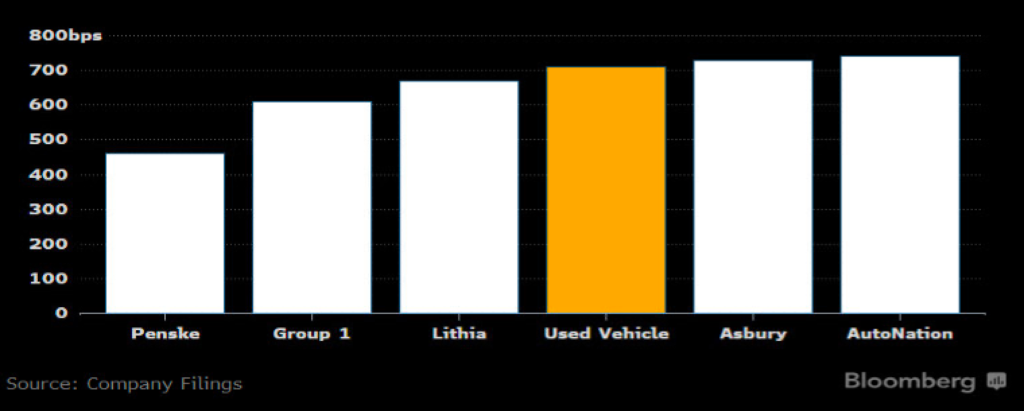

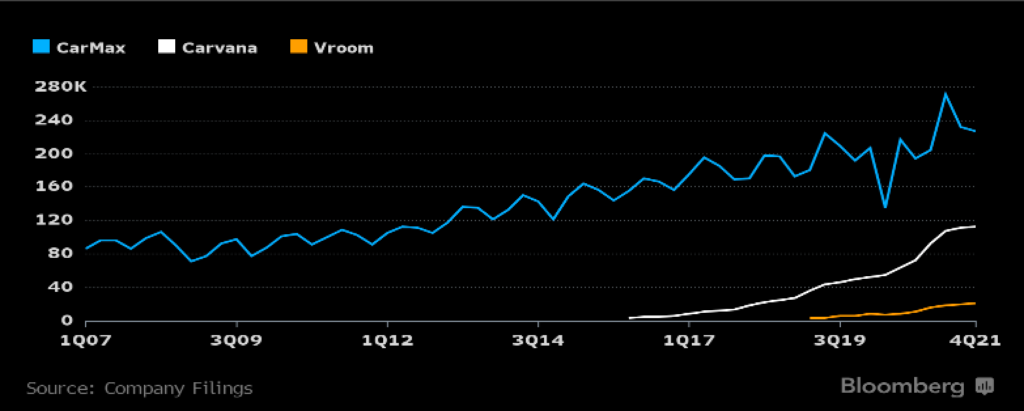

But with seeing no end in sight for supply chain constraints, and semiconductor supply shortages, the prices of buying a new or used car have increased, and consumers, for now, are willing to pay up for them. The average price of a new car has risen more than 20% in 2021 to ~$47,000. Likewise, the average used car price in February was ~$27,000 and is expected to rise further for March. Individuals are more likely to purchase a used car for the most obvious reason being price, but also the feasibility of buying a used car online. With pressure on legacy dealerships to focus on new car margins, this offers opportunities for used-car retailers like Carvana to grow further. With the pandemic making us gravitate to the ‘online-only’ mentality, the prospects for the growth of companies such as Carvana seem to be rising.

Carvana is the second-largest used-vehicle retailer behind Carmax, best known for its multi-story car vending machines, and who may be venturing to a hybrid format with its recent acquisition of Adesa for $2.2 billion. With Adesa under their belt, they could 4x their retail revenue to $36 billion and possibly surpass Carmax. As consumers become more comfortable with making larger purchases online, they could possibly expand their market share to 6%.

Carvana is yet to be profitable, but a possible collaboration with Amazon could put Carvana at the forefront of the online used car market and grow Amazon further. With Amazon already establishing itself in the hybrid model, and Carvana venturing into the model, there is a compatibility between the two firms that I think can be profitable.

Reclaiming history in movie distribution

Last March, we saw the prominence of AMC stock as Reddit traders forced a gamma squeeze on the classic, middle school weekend rendezvous. The company is now down nearly 74% since that spike and has had some people—me—confused with their recent stake in Hycroft Mining. But as the recent box office numbers for Batman and Spider-Man: No Way Home show, the theaters are thriving, even after a year of pure at-home streaming.

But, as you may have guessed, these recent successes overshadow some real hurdles in the theater business. As with the case above with online shopping for vehicles, an $11 billion recovery in movie theaters’ sales may not happen, as studios find it more viable to send their mid-sized films to streaming platforms like Disney+ and Netflix. For the first time since the pandemic hit, Cinemark was profitable in Q42020. Sales were around $666 million and cash from operations jumped to $208 million, boosting liquidity to $707 million. Though, not all is lost. Big name Netflix and other competitors like Disney are struggling to add new subscribers in developed and emerging consumer markets, and their massive gains are dwindling.

Furthermore, theater movie windows are now shifting to 45 days from 90-95 days, forcing streaming services to reconsider their plans. While this may shave off nearly 6% of total annual revenue for theaters, the reality is that more than 75% of box office revenue is made three weekends in — and some films are making 95% of revenue within the first 45 days.

For a company that is already relatively successful to peers in the streaming business, Amazon may benefit from capturing the older movie distribution channel and have more success in the hybrid model than its competitors. With competition only in theater or only in streaming, Amazon can capitalize on both areas of the market and boost profitability. Furthermore, Amazon has recently closed a whopping $8.5 billion deal to acquire MGM Studios, pushing it further into the arena of movie distribution — making me believe vertically integrating into the theater business is not far off the sight of the e-commerce giant…

But alas, the world is not a bed of roses: antitrust issues and short term growth hurdles

Obviously, vertically integrating into the theater business or car dealerships is probably sending some red flags — and we are not the first to see its issues. Even though FTC is allowing a 30-day review period, and the EU Commission did not see any conflicts with MGM acquisition, the House judiciary has voiced that Amazon may exhibit anticompetitive behavior. In their findings, they found many contradictory testimonies from former employees, and current and former sellers, that “Amazon gave preferential treatment to its own brands within its store’s search results, something [Amazon] has also denied [in their side of reporting].” While the acquisition has gone through, this has not overshadowed other Amazon tactics that the FTC finds potentially harming small businesses and consumers. Furthermore, in its recent earnings report, Amazon stated labor has become a major supply constraint for the giant alongside inflation pressures that could increase its costs to $4 billion. Growth has slowed and issues have been rising for Amazon, from anti-trust to daily operations, which may or may not self-regulate the e-commerce leviathan.

Not Financial Times (NFT) is an Opinion column created by Roshni Revankar ‘22 to share insights and research into students’ favorite companies, industry trends, and anything in financial markets that really irks their curiosity.

Be First to Comment